Review – ADCB Traveller Credit Card (Part 1 of 2)

ADCB Traveller Credit Card is one of the 4 UAE credit cards in my portfolio. I have been holding it for a year now and I have decided to renew it.

Why? Read below for a comprehensive review of the card.

ADCB Traveller Credit Card

Abu Dhabi Commercial Bank (ADCB) is one of the largest banks in UAE. In May 2019, ADCB, Union National Bank (UNB), and Al Hilal Bank merged on Wednesday to create the UAE’s third largest bank with AED 423 billion in assets.

ADCB Traveller Card is the second most premium card offered by the bank. As the name suggests, this card is catered to the needs of the frequent traveler. The key features of this card are:

- Annual fee: AED 1,000 + VAT

- Type: MasterCard World Elite

- Minimum salary: AED 20,000

The key benefits provided by ADCB Traveller Card are:

- Sign-on bonus of AED 1,000 (as hotels.com voucher)

- Further hotels.com vouchers based on spends on the credit card

- 20% discount on hotel bookings at hotels.com

- 20% discount on flight bookings at cleartrip.ae

- 0% foreign exchange transaction fee

- Earn TouchPoints on every spend

I have used all these benefits in the past year and will write about these in more details. There are some other benefits on this card including:

- Airport lounge access (primary and supplementary cardholders)

- Complimentary travel insurance

- Discount at Yas Island attractions (Ferrari World, Warner Bros World etc)

- Complementary round of golf

For full details, visit the ADCB website.

Let us look at each of the key benefits in more detail. This is going to be a long post so I have divided this into two parts. In the first part, I shall cover the hotel benefits / discounts provided by this card.

Sign-on bonus of AED 1,000

When you sign up for the ADCB Traveller Card, you are provided a coupon code which can be redeemed for AED 1,000 credit on bookings at hotels.com. This will cover your annual fee making the card free. However, there are some conditions you must be aware of.

- The hotels.com is provided after 3 months of signing up for the credit card

- You need to make a minimum booking of two nights

- Many hotel properties are excluded

In spite of these conditions, if you are a frequent traveler, you should easily be able to use the coupon code.

Spending linked credit on hotels.com

ADCB Traveller Credit Card provides you up to 6 nights of complementary stay upon achieving certain annual spend thresholds. Like the sign-on bonus, these are also provided as coupon codes that can be used on hotels.com for a credit of AED 1,000. Once again, you need to book a minimum of two nights and there are many exclusions. The thresholds are as follows:

- AED 1,000 voucher on spends of AED 150,000

- AED 1,500 voucher on spends of AED 200,000

- AED 2,000 voucher on spends of AED 250,000

20% Discount on Hotels.com

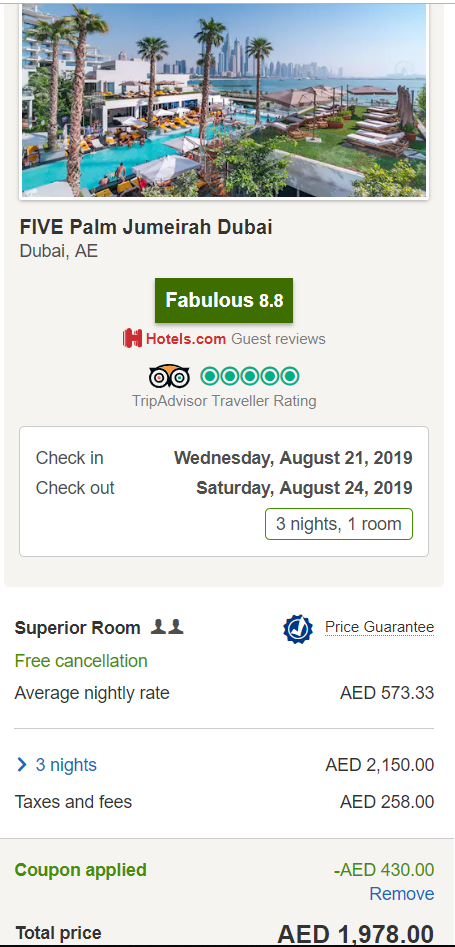

For me, this is the single most important reason to keep this card in my wallet. You can get 20% discount on most properties listed on hotels.com/adcbworld. Remember this is not a cashback but a discount. You need to use the coupon code “ADCBWORLD” before payment. Obviously, you can make only prepaid bookings to use this offer. However, you can choose bookings with free cancellation.

There are no restrictions on minimum nights or room rates. The only condition is that you can make a maximum of 12 bookings in a calendar year capped at 28 nights per booking. This is a large enough number for me and it should be for most people.

This is how it works:

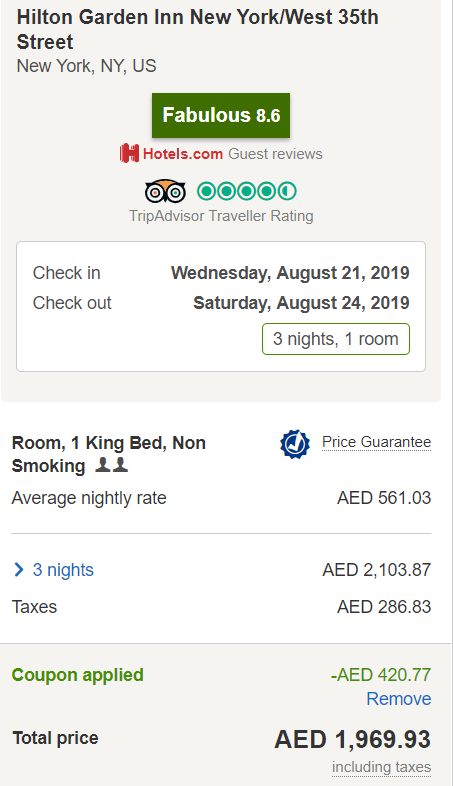

As you can see, a 20% discount is applied on the base fare. Technically, if you are a frequent traveler, you can save a lot with this credit card. However, there is a major catch here.

You can read the full terms and conditions for the ADCB Hotels.com partnership at this link. According to this, there are many hotels in the exclusion list here. Now, this covers almost any hotel chain I can think of including Marriott, Hilton and Hyatt. The good thing is, this exclusion list is not adhered to.

For example, the coupon works on Hilton Garden Inn, New York and Taj Mahal Palace, Mumbai even though both properties are excluded.

However, it does not work on JW Marriott Marquis Dubai.

To conclude, it is bit of a chance you are taking with this card. You never know when the 20% discount would work. Do I wish that ADCB and Hotels.com sort out this confusion? Of course. However, I can tell you that I have used this credit card several times over the past 12 months. I have saved at least AED 2,000 in the past year on hotel bookings.

Please wait for the second part of the series where I explain the 20% discount on Cleartrip.ae, 0% foreign transaction fee and ADCB TouchPoints.