Introduction to Points and Miles in the Middle-East

Hello and welcome to my blog. I have followed multiple travel and credit card blogs in several geographies. However, this is my first attempt at writing one.

I had moved to Dubai in 2017 and being the points and miles freak I am, I was rather surprised not to find a forum that could help expats like me. As a result, I decided to start one on my own. While my initial focus will be on the UAE, I plan to gradually expand my blog to cover the MENA region.

As readers would know, the three largest loyalty reward channels available are – credit cards, airlines and hotels. Middle-east offers a staggering array of choices in each of these (something I realized only after I moved here). For instance, Emirates NBD – a local bank – is the only bank outside of USA to offer a Starwood Preferred Guest co-branded credit card. To understand the situation better (and to appreciate the need for such a blog), I am summarizing the various options here.

Airline Loyalty Programs

Unless you have been living under a rock, you have heard of Emirates and Etihad. These are among the largest airlines in the world – both in terms of network and number of passengers carried. If you have visited UAE, you would have probably come across flydubai as well – a niche airline connecting some exotic locations. However, the last time you checked the flight options, did you check AirArabia?

AirArabia flies out of Sharjah International Airport or SHJ (30 min drive from Burj Khalifa; DXB airport is 15 min drive). AirArabia has an all Airbus A320 fleet (think Jetblue from US or Indigo from India) and has an extensive network in the 2-4 hours distance across Middle East, North Africa, Asia and even Eastern Europe. In other words, AirArabia can be a great option for some last-minute bookings as seen below

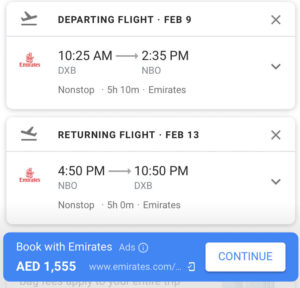

Comparing a trip to Nairobi in February

Compared to Emirates, AirArabia is significantly less expensive

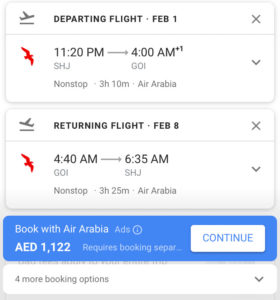

Or perhaps you fancy a trip to GOA

Source: Google Flights as of January 24, 2019

No other airline in UAE flies direct to Goa (including the Indian carriers).

While this may sound like a pitch for AirArabia, it is not. It is just a reminder that there are 4 airlines native to the UAE (including FlyDubai which has all but merged into Emirates). If you are based out of Dubai, all of them are accessible at reasonable distances. Like Emirates Skywards and Etihad Guest, AirArabia also has a loyalty program (called Air Rewards) and co-branded credit cards as well. A detailed comparison to follow soon.

Hotel Loyalty Programs

UAE is home to approximately 200 five star hotels (source: Booking.com) – any hotel chain you can think of would probably be present here. Some of the leading ones are

Marriott / SPG / Ritz-Carlton – 40 properties across various brands

Hilton – 26 properties

Intercontinental – 30+ properties

Jumeirah (chain that owns Burj-Al-Arab) – 10 properties

Anantara – 6 properties

Rotana – 9 properties

In addition, there are several niche brands hotels as well – Taj, SLH, Melia etc.

As you can see, UAE offers a staggering array of choices to earn and burn hotel points. Another very unique aspect to UAE is the stark difference between nightly rates in the low and high seasons. While, luxury hotels like JW Marriott Marquis sell for a nightly rate of ~AED 1000+ in the peak season, it goes as low as ~AED300 ($50) in the low season. Moreover, some of other Marriott/ Hilton hotels go even lower at ~$30. These rates are an absolute steal if you are ok with the Dubai summer (air conditioning everywhere) or if you have a few nights to cover to achieve / preserve elite status with these hotels chains.

Credit Cards

While cash usage is very high in UAE, the credit card acceptance and usage is good as well. For instance, most of the large malls, supermarkets and high-end restaurants accept Diners and Amex cards. Additionally, smaller merchants accepts Visa and MasterCard on transactions as small as AED 10. Banks in UAE can be divided into three categories

- Global Banks – HSBC, Citi, Standard Chartered, ABN Amro

- Commercial UAE Banks – Emirates NBD, ADCB, FAB / NBAD, Mashreq

- Islamic UAE Banks – ADIB, Noor Bank

Most of these banks offer the following cards

- Visa / Mastercard variants – Platinum / Signature / Infinite etc

- Travel cards – Either with an airline, a hotel chain or an OTA

- Other co-branded cards – With a telecom company, a supermarket etc

While expenditure varies monthly, my average credit card spending is as follows – Utilities – 20%, Groceries – 20%, Dining – 20%, Travel – 20%, Others – 20%. My biggest gripe against the credit cards is that they offer as low as one-tenth of reward points for groceries and utilities – roughly 40% of my spend. But do not worry, there are some workarounds, and for that please continue to follow my blog 🙂

AK

The “Introduction to Points and Miles in the Middle East” article by PointsofArabia provides a great introduction to the world of points and miles for Middle Eastern travelers. The article highlights the best credit cards, loyalty programs, and travel hacks for earning and redeeming points and miles in the region.check out our blog at- https://www.mileagespot.com/ for more insights