Pay Your Rent and Other Payments With Citi PayAll

I accept that I am a credit card freak.

Given a choice, I would pay every dime (or fils) with my credit cards. Not because I am in need of ‘credit’. But because I love earning reward points, miles and cashback. The two posts below provide a good indication of my credit card strategy.

How Did I Save $4,000 (AED 15,000) in 2018?

Half Year Update – I saved $2,200 through credit card offers

However, some of our biggest expenses cannot be paid using a credit card. Rent is a prime example. Some schools do not accept credit cards as well. Other examples include salaries to domestic staff, government payments etc. I have always wondered if I could earn credit card reward points on these payments.

Introducing Citi PayAll

Citi PayAll was launched in UAE in September. Earlier, it also had a trial run in South Asia. If you hold a Citi credit card, check your SMS / E-mails.

So, this is how it works.

- You could schedule a payment to a third-party bank account using your credit card

- Reason for payments needs to be provided and will be verified – Rent, School fees etc.

- It will take up to 7 working days for the transfer to be completed

- A processing fee will be charged (in my experience it was 2% but may vary)

- You will be provided reward points as per your usual earnings

A processing fee of 2% may seem high to you. However, I believe it gets easily compensated with the reward points on offer.

Let us assume I used Citi PayAll to pay a rent of AED 10,000 ($2,722) with my Citi Prestige credit card. I got charged a processing fee of AED 200 ($54). I also received 5,444 ThankYou points (2 points per US$).

I value my ThankYou points at a minimum of 1.5 cents. This is because I could transfer it to several airline partners including Etihad Guest, Singapore KrisFlyer and Turkish Miles&Smiles. If you are not keen on doing that, you could simply use your points on the Citi Rewards portal for a 1 cent each. I plan to write a separate post with details on how to use your Citi ThankYou points.

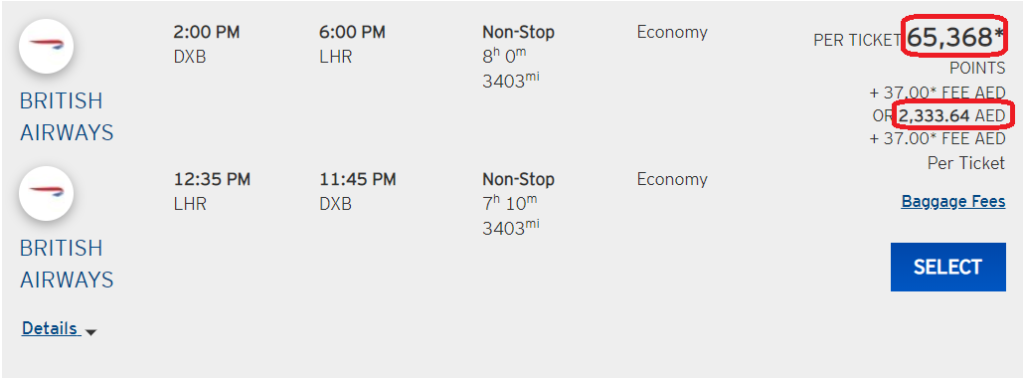

As you can see above, you can use your ThankYou points on Citi Rewards Portal for flight / hotel bookings. In this example, you get a value of AED 2,333.64 for 65,368 points. This is roughly 1 cent per point.

At 1.5 cents per ThankYou, I got a 3% cashback. At 1 cent per ThankYou point I got a 2% cashback. This should offset the processing fee.

Your credit card will be charged and the amount will be due as per your statement cycle. In other words, if your credit card is charged on the 5th and if your statement date is 15th and due date is 30th, you need to pay your credit card bill on or before 30th. Therefore, using Citi PayAll may help to manage your cash flows as well.

Final Thoughts

It is a one-of-a-kind feature in UAE. I hope other banks follow suit and introduce such interesting features. I have used Citi PayAll and it works seamlessly. This has made my favorite credit card (Citi Prestige) even better.

If you wish to apply for Citi Prestige or other Citi UAE credit cards, you can use this link.

A word of advice here. Please do not use this feature to make payments you cannot cover by your statement due date. It is a recipe for disaster.

Amazing feature that I would be excited to use for my rent payment.

Do you have extra detail of how this actually works with agents/landlords?

Who is actually charging the credit card, etc?

Any insight would be appreciated.

Hi Joshua,

I have used it to pay my landlord. If you have received the link from Citi, click on it. That will take you to the page where you can enter the account details of your landlord.

Your card will be charged by Citi. This will be done a few days before the amount is transferred to the landlord.

Simply put, it is like a cash advance on your credit card without the high charges.

Hi

Can you still use the prestige card for payall ?

The current list of cards on the website mentions only the premier card.

Hi

You are right the website excludes Prestige. But I just made a dummy transaction with my card and it works.

Thanks

Is this currently the only way to pay a rent using credit card?

Hi, I was thinking of using payall with my citi premier card to pay my rent. However, after checking I will be paying 1% of the amount as fees. So if I spend 100,000dhs rent, I will pay 1000dhs in fees. I will earn 40650 thank-you points. As per my research these points are valued at 1 cents per point. Hence equal to usd406 or 1500dhs.

So I would earn 500dhs. Is it worth the trouble? Or I am missing something?