Remittance and Money Transfer Options in UAE

The UAE is home to over 200 nationalities. The citizens (called Emiratis) constitute roughly 20% of the total population, making UAE home to one of the world’s highest percentage of immigrants.

A corollary to this is that UAE is one of the largest remittance markets in the world. In Q4 2018, total remittances from UAE amounted to AED 39.9 billion ($11 billion).

Due to the large volumes of remittances, UAE has several options to send money. In this post, we will discuss the pros and cons of each.

Exchange Houses

UAE is home to several exchange houses like UAE Exchange, Al Ansari Exchange etc. It is likely that you will have a couple of exchange houses within a kilometer from where you are.

Exchange houses are also the clear choice for thousands of low-wage expats in Dubai. The transfer process is very simple. You visit a branch and provide your details. Then, you deposit cash. Your transfer can take anywhere between 5 minutes to a couple of days depending on the country of remittance.

Note that most exchange houses do not take cheques or credit / debit cards. So, transferring large amounts can be challenging.

Exchange houses may charge a separate transaction fee (regardless of amount transferred) or the fee could be built in the exchange rate.

Convenience – ****

Speed – *****

Exchange rates – ****

Large amounts – ***

The bigger exchange houses are now providing mobile apps to ease your remittances. You can see the exchange rate and initiate the transfer through the app. You can choose to electronically transfer the money or visit the branch to finish the transaction.

Tips & Tricks

If you want the most favorable rate, look around and visit few different exchange houses. Most malls in UAE have at least two or three.

Also, the rate shown on the app might be better than the branch. You can initiate the transaction on the app, fix your transfer rate and visit the branch to deposit the cash.

Bank Transfer

This is the second most popular remittance method. But also the easiest to make a mistake on. Banks, whether in UAE or outside are notorious for hiding the full costs involved. For example, while transferring to US or EU be mindful of incoming wire charges levied by your bank.

The process is simple. You add an international beneficiary in your local account and transfer the amount. However, the exchange rates may not be ideal and varies a lot between the bank and the foreign currency.

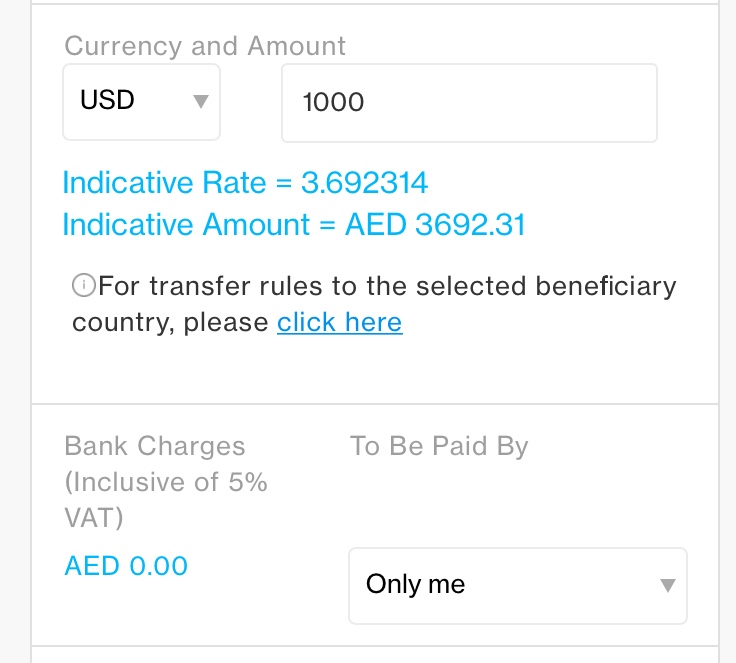

As an example, Standard Chartered can to AED to USD transfer at a rate of 3.6923. This is only 0.5% higher than the fixed exchange rate of 3.67250. No other charges are levied.

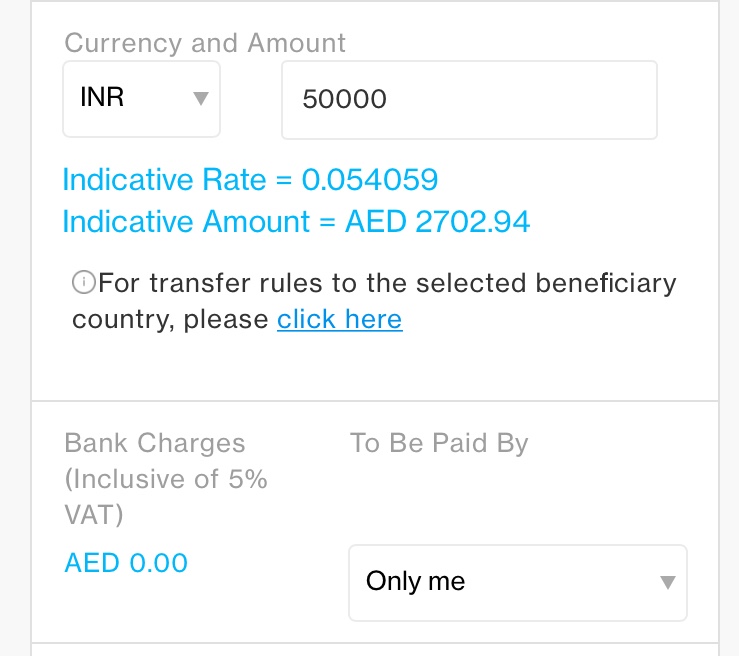

However, while transferred from AED to INR, Standard Chartered is offering a rate of 18.48. This is 2% lower than mid-market rate of 18.84 as per XE.

Similarly, I have seen Emirates NBD offers excellent rates of AED to INR transfer but not for AED to GBP or USD.

To conclude, bank transfers is one of the most reliable ways of transfer. However, exchange rate varies between banks and the type of currency.

If you need to transfer large amounts, bank transfers might work out best. Both your UAE bank and international bank know who you are. Therefore, there is unlikely to be any restrictions based on the amount (such as an extended identity verification).

Convenience – *****

Speed – *****

Exchange rates – ***

Large amounts – *****

Cryptocurrency

Before you resolve never to open this blog again, I am not selling Bitcoins. And yes, I have made and lost money in crypto.

This is what you can do:

- Create an account with a crypto exchange which lets you fund in AED (e.g. Bitoasis)

- Fund your account

- Create an account with your destination country (e.g. Coinbase for USD)

- Buy any crypto which can be transferred quickly to another account

- Transfer crypto to your destination account

- Sell crypto to get destination currency

- Withdraw to bank account

Needless to say, this is quite complicated. However, you will get almost mid-market rates here. Buying and selling crypto has minimal trading costs. In some cases, you might even get a premium. There are two things to me mindful of:

- You will hold the crypto for 5 min to 30 min. You are exposed to volatility during this period.

- There might be tax implications in your country of destination.

Convenience – ***

Speed – ***

Exchange rates – *****

Large amounts – **

E-transfer / App-based transfers

There are a few money exchanges on internet and /or mobile apps. Some of the famous ones are Xoom (by PayPal) and TransferWise.

The transfer process is the same as exchange houses. The only difference being that you can do everything over a computer.

Most of such apps use the traditional banking channel. They save on rates through preferred relationship and volume transfers. Some of these savings are passed to the customers. Hence, the transfer rates can be lower than bank rates. The disadvantage is that there is a trade off between speed and exchange rate. The quickest transfers typically happen at a worse exchange rate.

Transferring large amounts is possible, but typically this will required an extended identity verification (KYC) process. Some of these websites has a monthly transfer limit as well.

Convenience – *****

Speed – ***

Exchange rates – ***

Large amounts – ***

Bottomline

Of the four methods discussed, there is no single winner. Your choice will depend on the four factors – convenience, transfer speed, exchange rates and the size of transfer.

Hi. This is a very helpful article. When I lived/worked in Dubai (2012-2013) reliable money transfer options were scarce. I opted for Emirates NBD even with the higher (to USD) rates because, as you aptly pointed out, no upper limit and reliability. As I was repatriating back to the US, app-based remittance processes were just taking shape. Former colleagues still in the UAE continue to stress over the best way to remit money back to their home/local banks; I’ll definitely be passing your helpful hints onward to them. Thanks again!

Thank you. Really appreciate your comment.