Review – ADCB Traveller Credit Card (Part 2 of 2)

Thank you for taking time to read my blog. In Part 1, I had written an introduction to ADCB Traveller Credit Card and the hotel discounts you can get.

In Part 2, let us look at some of the other key benefits.

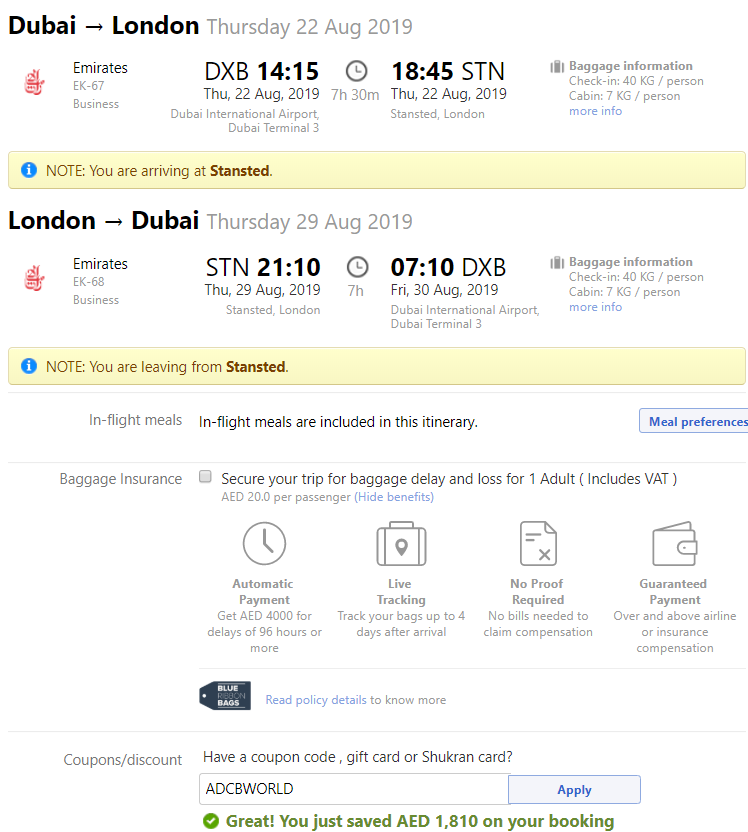

20% discount on flight bookings at cleartrip.ae

This is the second most important reason why I am holding this credit card. You can book your flights on www.cleartrip.ae and enjoy a 20% discount on the base fare i.e. exclusive of taxes, fees and other charges. You need to use the promo code ADCBWORLD during payment. The discount is applicable on all fare classes. You can make up to 6 bookings per card in a calendar year, capped at 9 passenger tickets per booking.

There are certain exceptions though. Your itinerary has to be a round-trip. This is how it works:

As you can see, higher the base fare, greater the discount. The discount can be really substantial for business-class bookings, when base fare is a lot more than other charges.

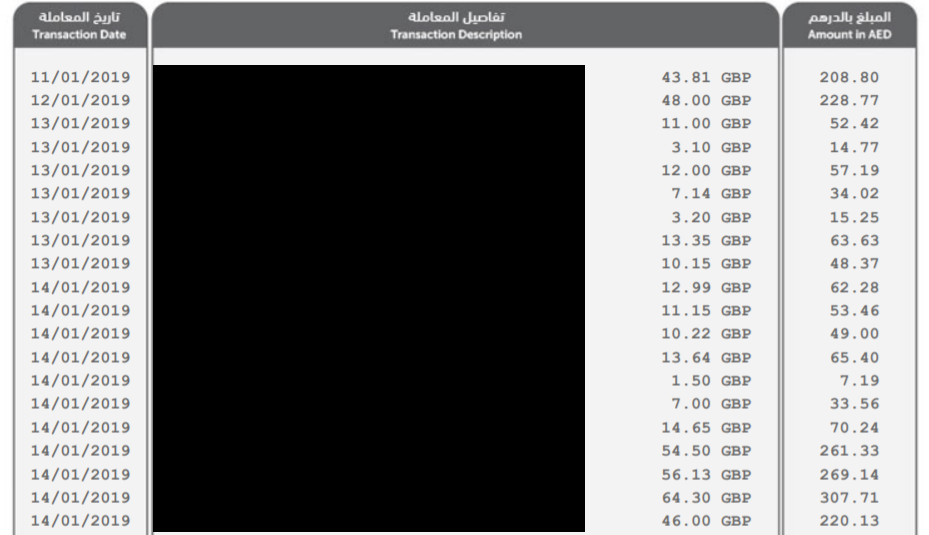

0% foreign exchange transaction fee

ADCB Traveller Credit Card is the only credit card in UAE that claims to offer zero foreign exchange charges. I had used the card when I was in London in January 2019. Let us look at the transactions

During that time, the mid-market rate was 1 Pound = AED 4.70-4.73. If you look at the transactions above, the conversion rate varies between 4.76 – 4.79. Do you wonder why? The devil is in the details.

ADCB states that “Pay 0% processing fee when you use your Traveller Credit Card overseas”. It means that ADCB will not charge any additional charge on your foreign exchange transactions. However, MasterCard still charges you between 1%-2%. This is the reason for the difference.

Don’t get me wrong. I am happy paying 1% on my foreign transaction when other credit cards charge 3%. At the same time, there is a trade-off here. Most credit cards give higher reward points on international transactions. For example, my Citi Prestige credit card gives 3 ThankYou points per USD of international spend vs 2 ThankYou points for domestic spend.

Earn and Spend TouchPoints

Like Citi ThankYou points or American Express Membership Reward points, ADCB has its own currency – TouchPoints. With the ADCB Traveller Credit Card, you earn 2 TouchPoints per AED 1 of spend. If that sounds generous, it is because TouchPoints are worth very little. You could convert TouchPoints to vouchers at a lot of establishments within UAE. The full list is available at ADCB TouchPoints website.

The typical ratio is 8,334 TouchPoints = AED 50 or 1 TouchPoint = AED 0.006.

You could also convert your TouchPoints to Etihad Guest miles (14 TouchPoints = 1 mile) or Emirates Skywards miles (18 TouchPoints = 1 mile).

To summarize, the earn and burn opportunity is not great in this credit card. The real value lies in the other benefits.

However, in 2018 ADCB was being very generous in awarding TouchPoints. I had received multiple promotional offers from ADCB which multiplied the earnings 3-5 times on particular spends. Even for redemption, at one point ADCB offered 3 times Etihad Guest miles than the usual rate. So far in 2019, these promotions have been missing.

Final Thoughts

We are at the end of a long post. Should you get this card or not?

I suggest if you travel more than 3-4 times a year and pay for your travel expenses using your own credit card, you should definitely consider ADCB Traveller Credit Card. For each trip, I have saved more than AED 1,000 using hotels.com, cleartrip.ae and foreign exchange charges. This should easily cover the annual fee.

Hi,

Congrats on a nice “niche” blog. Unfortunately there is lack of wisdom exchange when it comes to tips, tricks and perks of the credit cards in the UAE, apart from few random users on Reddit. Half the smaller country where I used to live, have tremendous forum about spending, credit cards points, perks, bonuses etc. We miss that here unfortunately. One of the reason is probably “cash” being so popular here for such a long time.

Anyway, back to the topic, I would like to contribute a bit about Traveller card, just to clear and add some things. I used this card heavily pretty much since day 1 it was released:

1. There is absolutely no limit on earning TP regardless of the category spend, apart from online banking bill payments. These are capped at AED 3,500. So just make sure to not use internet banking at all for online payments or remember to keep it below AED 3,500. With apps like DubaiNow, where you can add all your utilities, Salik, Dubai police fines etc, these all can be paid via credit card just with few clicks (pay all feature).

2. The welcome and renewal hotels.com vouchers do not have to be used for X nights. This is for illustration purposes only. You can use AED 2000 voucher (if you reach AED 250,000 spend) for a single night if you want.

3. The exclusion list has always been there since day 1 but the link for excluded hotels hasn’t worked for like 1 year. I have even reported this to hotels.com . As you said, it is strange they provide this exclusion list, because in my experience wherever I see a possibility of paying in advance, I can use this discount. I was booking for a friend 2 weeks stays at JBH worth AED 70,000 and indeed the discount was 20% , so the saving amount was significant. Also when you check some nice hotels like O&O Maldives, you can see the discount works there too. Savings can be tremendous. There are few “buts” though:

– the booking has to be prepaid and a lot of the hotels at hotels.com doesn’t have this option, despite being available at other places like booking.com…

– I have noticed, especially in UAE, the prepay offer for top hotels disappear 3-4 weeks before stay (Atlantis, Jumeirah etc).

4. Cleatrip is inflating business class prices on all the airlines, but what I care most is the Emirates, since I fly only with them. You can also see they are doing this in purpose, because when you change their website country to US, the prices for business class tickets are the same as at the airlines. While the 20% discount still works a bit cheaper than booking directly, the offer is much less attractive. As I have this card since “day 1” it was released, this issue has not been present at the beginning. I made few business class bookings at the same rates as Emirates business. Keep in mind I am not talking about fare differences, as Cleartrip has no fares selection, so they take the cheapest available. I had a couple of spicy email exchanges with Cleartrip and also brought the case to the higher ups at ADCB, but there is no resolution. Cleartrip firmly stands these are the rates from the airlines, which is obviously not true and in contradiction to their US country page fares. There was a time (maybe after 1 year) when they introduced this “inflated” rates and they keep them. There was one glitch in their system when EK had early year sale and they offered the same prices, so I took advantage but they addressed this “issue” quickly without changing my fares. I basically “hit” them with their system mistake, which offered the same rates as Emirates (which the system always should offer anyway) 🙂

5. ADCB has few days ago revamped their TP website, so it is more transparent now. One significant addition is the ability of redeeming TP directly on Cleatrip website. I checked and it works, you enter the card to check your TP amount & cash equivalent and you can apply them. The good thing is that it is treated as per instant redemptions rates at AED 50 for 8334.

6. I learned to stop collecting miles / points for miles etc. Cashback is the king. There are few reasons I came to such conclusions:

– I had BA Gold and plenty of miles and they simply expired. Where I lived (SIN), the route to LHR was very popular, so there was no chance to redeem anything for 1 person on short notice (maybe last minute from one day to another). I couldn’t plan anything that much in advance of a year. It used to be better in the past with the redemption availability but since few years BA Exec went downhill.

– travelling business with a family it is almost impossible to book or upgrade 4 redemption awards in business at the same time. It was a struggle on BA for 1 person. With EK I managed to upgrade once 3 of us, but now with family of 4, this is almost impossible.

– I rarely travel alone this days, maybe 2 times per year on business trip. This is usually when I need to travel on particular day and usually come back next day. Something I cannot count on business class awards availability.

7. Cashback (in TP form) on this card is 1.20% and there are really many places to redeem them (Cleatrip being the only instant online place). Emaar Gift card is one of the popular ones, as you can spend it at any place in Dubai Mall or Marina Mall, including Apple stores etc. The cherry on the cake is to wait for 10% bonus on Emaar Gift cards (2-3 times per year) and then redeem TP. Last April/May they had specific 10% top up promo on Emaar Gift card for ADCB. Also each 1,000 TP redeemed entered a drawing competition in ADCB where there were multiple winners of 1 million TP (AED 6,000) and I was one of them. Beside, as you mentioned, lot’s of targeted promo: on school fees payment (apparently via online banking portal counts as well up to AED 3,500 only…), on international bank transfers above AED 1,000 (15,000 TP).

8. I wish TP statements would be more transparent. At present state, it is absolutely impossible to keep track whether correct amount of points were awarded for transactions. Detailed breakdown is missing.

9. My experience with FX 0% is the same. The FX rate is usually 1%. This is down to AED conversion. I have a MasterCard in Europe with FX 0% in EUR currency and any transaction in other currency gets mid market rates, without this 1% difference. But as you say 1% is acceptable. Not sure what is the FX charge on Prestige card but I bet it is at least 2% + 1% (MC), so 3%. On a purely cash back basis, you are still a bit better with Traveller World due to 1.2% cashback vs Prestige 2.45% on international spend (or 2.72% if you redeem TY against travel related expenses),

I also think that unlike hotels.com , cleartip system doesn’t verify the card details. You can enter the coupon code without providing valid credit card and at the end of the payment you can provide a different card, while the discount still stays. I have never tried it, since Traveller World is my primary card for this sort of bookings anyway, but it seems to be possible using a different card.

Going forward it would be great if you could in addition to earning points / miles redemption analysis, provide a cashback calculation for each card if possible. From what I gather, your favourite Prestige card earns unlimited 1.36% (TY) cashback and 1.82% if we redeem TY against travel related spendings (They are not precise about this meaning, so I wonder if car rental counts). This is of course for local spend in AED.

Also what are your thoughts on HSBC cards? Maybe I am missing something but their airmiles program is a bit underwhelming. Very limited choices. You need to spend AED 7000 to get AED 100 voucher. That’s 1.43% cashback on Premier credit card. You get double points at the Airmiles affiliated merchants. So considering I am heavy spender at Spinneys, that would be 2.86% cashback from purchases there.

All excellent points. I will put some of these nifty tricks in the post itself.

The cashback solutions idea is great, I will see what I can do.

HSBC Airmiles seems to be a poor cousin of Citi Premiermiles. Not great value.

I disagree a bit on the ‘cashback cards are the best’ hypothesis. Credit cards aren’t one size fits all. Your choice of card would depend not only on your individual spending pattern, but also on your reward goals.

If you prefer immediate discounts, cashback cards are a great choice.

On the other hand, I prefer to accumulate points and target ‘lifestyle’ rewards. For instance, I had transferred 100,000 TY points on Etihad Guest (this was back when it was 1:1 ratio). I redeemed those for a round-trip ticket business from Abu Dhabi to Johannesburg (already had the remaining miles in my account). I got a value of 2.5 cents per TY point for this.

Given Citi Prestige gives 2TY points per $ on all spends, I got an effective cashback of 5%.

I didn’t meant to say cashback cards are the best, because everyone has different targets and priorities. Also cashback specific cards usually have limits and are rarely (never) World Elite cards… It is more of collecting points and redeeming them to cash rewards at the best possible conversion rates. If I were alone or as a couple, I would probably hunt miles and spend them. But since our travelling patterns are pretty much the same across the year and considering we travel as a family mostly, miles are pretty much worthless due to inability of using them. If we wouldn’t have specific travel patterns and counties we visit, if we would have more flexibility in airline AND destination choices, miles are great. Before kids we flew with my wife SIN-FRA in SQ380 Suites just for fees and taxes, thanks to spending on Citi PM (SG) card.

With airline rewards you do get better conversion rates, like 5% as you said but you need to allow plenty of flexibility, both with the airlines redemption inventory, dates and destinations. These is where all these airline rewards are flawed, because it rarely allows you to book what you need to book on dates you need to travel. With kids in school, this is just impossible to move dates. This is the reason why I prefer certain 1.2% instead of uncertain 5%. But if there are cards which allow for even better earning potential like Prestige 1.36% or 1.82% (depending on the nature of cashback), that’s even better. With e.g. AED 250,000 spend per year we are looking at AED 4550 (Prestige 1.82%) vs AED 3000 (Traveller 1.20%), there is always “but” though. With Traveller we will get AED 2000 hotels.com voucher, so AED 5000 would bump this up to 2% cashback for Traveller card. Prestige card on the other hand has a bit weak annual renewal bonus of 10,000 TY, compared to quite hefty annual fee of AED 1,500.

These are great points and an awesome discussion.

I agree that airlines need to have more inventory towards redemption. It would be a boon for family travelers. I was a bit skeptical over accumulating airline miles as well (like you I also travel often with kids). Then I figured, I could redeem two tickets on business and book one revenue ticket (like for the AUH-JNB trip). It costs a bit more than economy but seems worth it.

Then there are hotel points. I have booked basic rooms with Marriott and Hilton and then paid a bit extra for upgrade to bigger room. So far, it has worked.

I like the ADCB Travelers a lot. But rather than making it my default card, I intend to use it only for flight and hotel bookings. Is 1.2% cashback on the card applicable on utilities, fuel, education and groceries too?

Whether I like earnings miles or not, it is impossible not to. Just by scanning some receipts from Dubai Mall app I have 10,000 miles. All the business class family bookings add up to it as well under family account at Skywards. You are probably right it it may be worth looking at splitting the booking, e.g. book for myself a redemption ticket and pay for the others. However it will all work good if you book on EK (as we fly EK only) website directly, since they can merge the separate bookings. If you book redemption via EK and book the rest via ClearTrip to avail discount, it may no longer be possible for EK to merge the bookings, because any changes prior to departure have to be handled by ClearTrip.

As for the hotels, I used to do it a lot in the past, we travelled with my wife quite heavily, before we had kids as my job allows such flexibility. So yes, I had SPG Plat, Hilton Diamond, Hyatt Plat. etc. We had some superb redemptions back then, e.g. NYE stay at Hilton Iru Fushi Maldives 4 nights for 170,000 points, that was a steal, VIP 7 category. Later on we did the same with Conrad Maldives for the same amount of points. We’ve got our point’s worth in terms of cashback like no others.

However after few years I have noticed one disturbing thing. The loyalty of keeping up the statuses make your travel patterns holding you to these chains. This lead to stupid moves, e.g. booking chain hotel, despite other better options are available. Also how many times will you keep coming back to the same properties / chains. And then you realize that some nice chains don’t have the loyalty programs at all, e.g. Four Seasons, O&O etc. It doesn’t mean you don’t get to experience an upgrade or something. E.g. I booked 3 nights at FS Paris George V via Virtuoso agent (they get benefits like guaranteed room upgrade on arrival, credit to spend etc) and was upgraded to a suite worth EUR 3k per night (booked room EUR 1k). I booked O&O Maldives via Agoda to avail some discount and got upgraded from beach villa to beach pool villa, something I would never expect, considering non direct booking.

I know we are a bit off here but one of the reason I like cashback, is that it allows for flexibility of spending vs “forced” reward that yielded in better cashback.

Traveller card has no caps on spending on any category. The only 2 caps are:

1. Up to the limit of your credit card in statement cycle. So if your credit limit is AED 100,000 but you want to spend AED 200,000 in the same billing cycle, you will still get points just for AED 100,000.

2. Online banking utility bills payment using Traveller card are capped at AED 3,500. So I don’t use online banking for utility bills. You can pay utility bills directly on providers websites e.g. DEWA, Etisalat, DU etc or via DubaiNow app, which is is a very good app. If you don’t know this app, try it. Unfortunately my school doesn’t accept credit cards (I think), so maximum I points I can get is up to the amount of AED 3,500 by paying it via online banking system using Traveller card.

Also please keep in mind that the 1.20% cashback is in the form of TouchPoints which you can redeem as you want, be it ClearTrip instant redemption when booking tickets or Emaar gift card or plenty of other options.

Again, it is hard to disagree with anything you have written.

You bring up an important point – is the perceived value same as actual value. It is a difficult question to answer.

Btw, I was trying to recall a post I had written on the value of TY points. Look here.

https://pointsofarabia.com/pay-your-rent-and-other-payments-with-citi-payall/

As you can see, TY points give you a value of nearly 1 cent for travel bookings on Citi Rewards. So, the cashback would be 2% here.